Engage your customers, impact their behavior and reward their loyalty.

Check the Loyalty API reference here.

This service is in BETA version. Read more on BETA versions in our Payments Glossary.

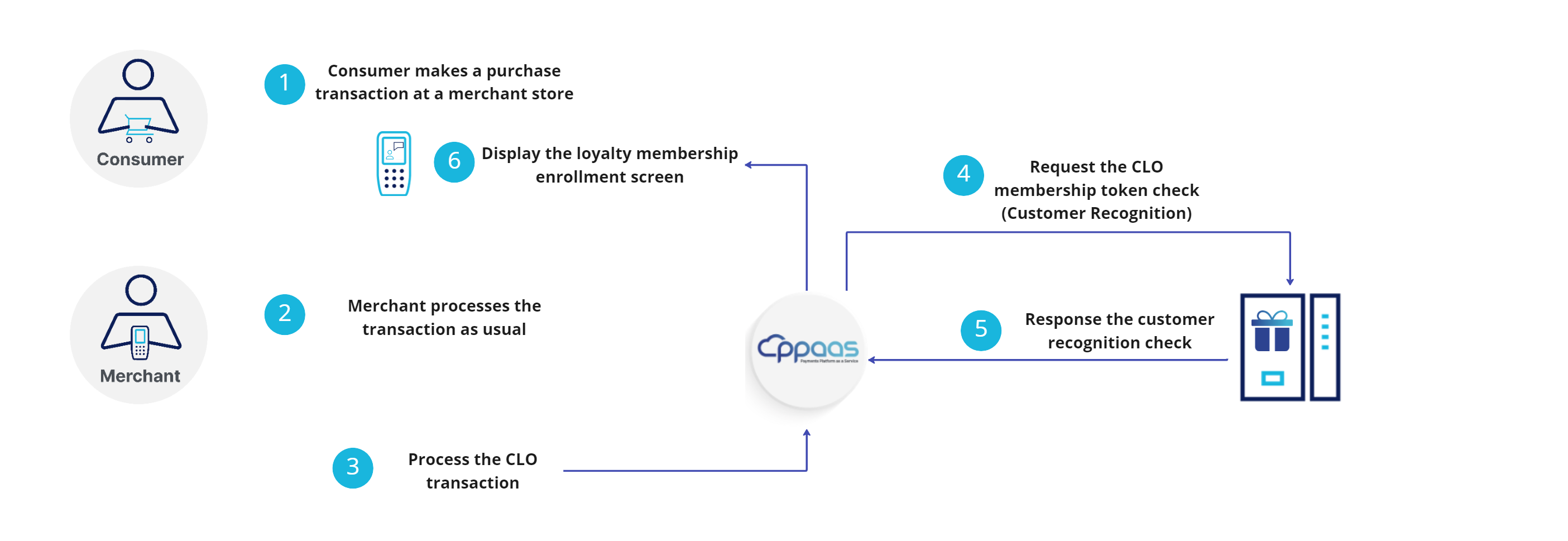

PPaaS offers the Card-linked-offer (CLO) program, which is referred to as a merchant offer, to acquirers and ISVs for their merchants. CLO has evolved beyond couponing and loyalty cards in recent years. During customer payment using cards or APMs, CLO automatically recognizes the in-store and online customers by detecting the CLO loyalty membership and notifying the loyalty provider. This allows the customers to use existing loyalty program rewards, avail of discount programs, accumulate reward points, use value-based programs by merchants, earn gift cards, earn cash back, or earn more rewards by shopping.

All the transactions in the stores of a merchant that subscribes to the CLO program are tokenized. During payment flow, PPaaS detects the membership by performing tokenization of the credit/debit card PAN; the result is matched with a token database containing all the cards that belong to the customer member of the CLO program. Also, the resulting token is used as a CRM token to identify the customer. During the payment flow, if the customer is not identified with any linked CLO, PPaaS supports customer enrollment to allow the merchant to attract more members to the loyalty program.

The transaction report flags the detected loyalty provider and the associated token. This token is pushed instantly to this loyalty provider. Now the loyalty provider notifies the customer immediately by sending a notification to the registered mobile number, which represents a strong added value for the loyalty program.

Enrolling customers to CLO and the workflow stages

Loyalty CLO services include the following functions:

Customer enrollment via a payment device and via a partner platform

Customer enrollment refusal

Customer recognition during the payment flow

Earning loyalty rewards from a transaction

Redeeming loyalty rewards (coming soon)

Prerequisites

Ensure that you have completed the following prerequisites for loyalty service:

You have registered a developer account and completed the authorization part.

Your payment device is enabled with a card-linked offer (CLO) service subscription.

Customer enrollment

PPaaS supports customer enrollment to CLO service through the following ways:

Customer enrollment via a payment device in-store

Customer enrollment via a loyalty partner platform

Customer enrollment via a payment device in-store

PPaaS offers merchants who subscribe to the loyalty service to enrol a customer seamlessly from a payment device after the payment transaction. During the customer enrollment process, the customer’s phone number or e-mail will be asked along with their consent to the data usage. For further information on our data privacy policy, please visit our PPaaS data privacy policy.

Overall flow for customer enrollment via payment deviceCustomer enrollment via a payment device

Customer enrollment via a payment device

Customer enrollment via a loyalty partner platform

PPaaS offers flexibility to enrol customers via our loyalty partner platform. The customer's information will be sent from our partner to PPaaS and registered as part of the loyalty membership. The customer’s card will be tokenized and used only for communication between PPaaS and our loyalty partner during the customer recognition process.

For further information regarding the PPaaS card tokenization service, refer to the tokenization service section.

Overall flow for customer enrollment via CLO partner

Customer enrollment refusal

Customer enrollment refusal functionality provides an improvement to the customer experience in-store. Once the customer rejects enrolling in the loyalty program, the enrollment invitation journey will not be presented through a payment device for a certain duration. Once the rejection time has passed or there is a new loyalty program created, the enrollment invitation journey will be presented to the same cardholder via the payment device again.

Please note that the refusal duration is configurable on the loyalty service provider platform.

Service Provider | Refusal Level | Waiting Duration |

|---|---|---|

Mobi724 | Loyalty program level | 60 days (default) |

Customer recognition with tokenization service applications

For further information regarding the PPaaS card tokenization service, refer to the tokenization service section.

Overall flow for customer recognition with the card tokenization service application

Overall flow for customer recognition for an existing customer

Reward earning transaction

Subsequently, after the customer recognition process, the enrolled customer transaction will be sent to our loyalty service provider to validate the reward eligibility and calculate the reward earning. After that, the customer will directly receive the reward-earning notification if the purchase transaction was eligible for any loyalty program.

Overall flow for reward-earning transactions

Configure card-linked offer loyalty services (coming soon)

PPaaS clients can configure the settings of the loyalty service intended to enhance their customer experience through a payment device. The customization in-store parameters focus on the user journey displayed on the payment device. The following table lists the configuration fields, most of the fields are toggle fields that the client can decide to activate or deactivate as required.

Configuration parameters | Description | Default value |

|---|---|---|

Customer enrollment via a payment device | Option to allow the customer enrollment journey in-store to collect information and consent through a payment device | Depending on the service provider |

Customer enrollment rejection via a payment device | Option to allow the customer to reject the loyalty program enrollment from a payment device, and the enrollment screens won’t be displayed to the customer for a certain period of time | Depending on the service provider |

Customer registration via a partner platform | Option to allow th e customer enrollment to be performed without a payment device (online) | Depending on the service provider |

Customer resignation via a payment device | Option to allow the customer to revoke the CLO membership via a payment device | Coming soon |

Customer revocation via a partner platform | Option to allow the customer to revoke the CLO membership via a partner platform and a loyalty partner to call PPaaS to revoke the card token | Depending on the service provider |

Card Tokenization (idToken) | Option to use PPaaS card tokenization with customer identification service (idToken) | Depending on the service provider |

Display reward earning | Option to allow the customer earning reward information to display through a terminal after making a purchase if the transaction is eligible. | Depending on a service provider |

Note: Please note that the configurations in the above table directly depend on the loyalty service provider’s technical availability.

Configuration parameters for each loyalty service provider

Configuration parameters | Mobi724 | Zeal (coming soon) |

|---|---|---|

Customer enrollment via a payment device | ||

Customer enrollment rejection via a payment device | ||

Customer registration via a partner platform | ||

Customer resignation via a payment device | ||

Customer revocation via a partner platform | ||

Card Tokenization (idToken) | ||

Display reward earning | ||

Display reward earning | ||

Loyalty reward redemption | Coming soon |